Cash can’t purchase you’re keen on, however it could trigger many issues for {couples}. In actual fact, it’s one of many predominant causes for relationship breakdowns. One monetary planning skilled says getting your monetary home so as might be simply as a lot an emblem of affection as flowers and goodies.

Deakin Enterprise College’s monetary planning skilled Affiliate Professor Adrian Raftery stated cash performs an essential half in relationships. However not at all times in a great way.

“It’s typically the principle motive for relationship breakdowns,” he says.

“So, whereas it may not sound very romantic, guaranteeing joint funds are so as is without doubt one of the keys to a cheerful, lengthy lasting relationship.”

Listed below are 6 golden cash guidelines for {couples} seeking to hold the romance alive.

6 Golden Cash Guidelines For {Couples}

1. No Secret Purchases

Affiliate Professor Raftery says irrespective of whether or not you’re in a brand new relationship or have been married for 30 years, communication is the important thing issue to an amazing relationship, significantly with cash issues.

“There ought to be no secret purchases or silent bank cards and loans. All finance selections ought to be consulted collectively earlier than they’re made,” he says.

“Failure to speak overtly and in a well timed method is sort of a hand grenade it is going to blow up in your face.”

2. Set Lifelike Targets

{Couples} must also write down their monetary objectives. This implies you’ve gotten one thing to work in the direction of and it’s essential to know what one another needs.

“Rating them offers them significance and provides you with a grasp plan to work in the direction of for years to return,” he says.

3. Make A Price range

The monetary planning skilled says {couples} ought to at all times guarantee that they’ve their payments paid earlier than doing anything.

He suggests utilizing Excel to do a funds and work out the quantity that that you must put apart every month in your bills.

“Open 4 on-line financial institution accounts for various financial savings – similar to home deposit, holidays, “wet days” and maybe a marriage,” he says.

4. Take into account A Pre-nupital Settlement

Some might say that this defeats the aim of marrying primarily based on the values of affection and belief.

Nonetheless, Affiliate Professor Raftery says a pre-nup is an efficient preventative measure towards a bag egg.

“Love hurts however divorce can price,” he says.

5. Share Monetary Tasks

Whereas it may be simpler for one particular person to be in command of all of the monetary duties, Affiliate Professor Raftery warn towards it.

“That is significantly essential in long-term relationships,” he says.

“I’ve seen many widows/widowers who should not have a clue with regards to funds they usually need to fend for themselves.”

6. Don’t Commit If Issues Are Rocky

Lastly, making monetary commitments like shopping for a home are massive selections to make.

If a relationship is rocky then it’s greatest to not decide to large money owed together with your accomplice says Affiliate Professor Raftery.

“There are many prices and hassles ought to the connection finish,” he says.

“If you’re in a brand new relationship, don’t go away your self financially weak by having any of your accomplice’s money owed in your title solely.”

In the meantime, listed here are 15 methods it can save you cash in your weekly grocery store.

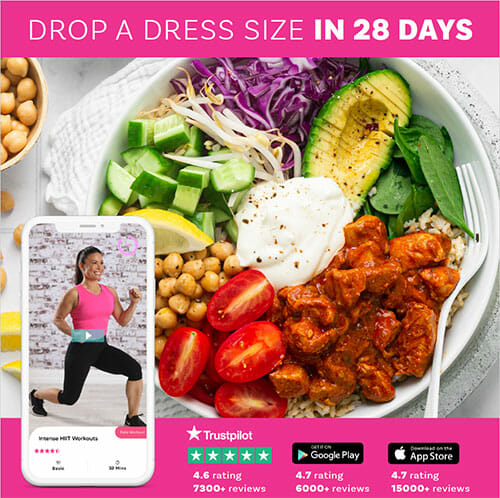

Able to Drop a Costume Measurement in 28 Days?

By no means Go Hungry

Our program presents NO 1200 calorie restrictions

Exercise at Dwelling

Comply with guided coaching movies with skilled health instructors (no gear wanted!)

Really feel Supported 24/7

In our personal assist teams with different mums similar to you!

Eat Scrumptious and Wholesome Meals

With family-friendly, weekly meal plans & over 6,000 simple recipes developed by nutritionists

No lock-in contracts, cancel anytime.