That is an version of The Atlantic Each day, a publication that guides you thru the largest tales of the day, helps you uncover new concepts, and recommends one of the best in tradition. Join it right here.

People like to hate the IRS, that traditionally unpopular revenue-collection company with its sluggish processes and fax machines and lots of, many varieties. However lately, it has began to show issues round, no less than by some measures: After receiving tens of billions of {dollars} from the 2022 Inflation Discount Act (IRA), the company’s customer-service wait occasions went down, its tech initiatives helped simplify tax filings for some, and its audits led to the restoration of greater than $1 billion in unpaid taxes from rich People and firms.

That progress could now be imperiled. As a part of the Trump administration’s plan to downsize the federal authorities, the IRS has been ordered to begin firing as many as 7,000 IRS staff within the center of tax season, together with 5,000 individuals who work on assortment and enforcement; the whole cuts characterize about 7 % of the company’s workforce. Extra layoffs might come: At the moment, the Trump administration launched a memo ordering all federal companies to submit plans to get rid of extra positions, together with these of profession officers with civil-service safety. The IRS’s performing commissioner, Doug O’Donnell, introduced his retirement this week, and Billy Lengthy, Donald Trump’s choose to interchange him, has beforehand backed laws that will abolish the IRS.

To think about the way forward for a diminished IRS, look again to the 2010s. By 2017, the company’s workforce had shrunk by roughly 14 % in contrast with 2010. The company’s audit fee was 42 % decrease in 2017 than in 2010. In that interval, People noticed slower refunds and delayed name occasions. There’s a tendency to conflate effectivity with value chopping, and generally leaner operations actually do velocity issues up—but when the IRS can’t afford to replace its arcane expertise or rent expert professionals, Vanessa Williamson, a senior fellow at City-Brookings Tax Coverage Heart, instructed me, it might wrestle to function effectively.

In a shift of focus, the IRS has prioritized auditing rich folks and firms since receiving IRA funding. In 2022, The Washington Submit reported that greater than half of the IRS’s audits in 2021 focused taxpayers whose incomes had been lower than $75,000, as a result of these audits are less complicated and might be automated; auditing rich folks’s tax returns can require way more sources, particularly if they’ve diverse earnings streams and property (and complex legal professionals or accountants). In Could, former IRS Commissioner Danny Werfel introduced that the company would drastically ramp up its audits of rich firms and other people making greater than $10 million. The taxes that wealthy folks evade annually quantity to greater than $150 billion, he instructed CNBC in 2024. Investigating them might repay: A 2023 paper estimated that each greenback the company spends on audits of rich folks might translate to $12 in recovered funds. And people who see their friends getting audited could also be discouraged from dishonest on taxes sooner or later, Williamson famous.

For generations, politicians have sought to politicize the IRS: In 1971, President Richard Nixon reportedly mentioned that he wished a brand new commissioner to “go after our enemies and never go after our associates,” and a former Trump chief of employees instructed The New York Occasions that Trump spoke of utilizing the IRS to analyze his rivals throughout his first time period (Trump denied this). The company’s politicization and unpopularity was a part of a “cycle that I hoped we had lastly damaged,” Natasha Sarin, a regulation professor at Yale and a former counselor on the Treasury, instructed me. When an company struggles to carry out its job effectively, its unpopularity makes getting extra funding to enhance its operations tougher, and so forth.

The way forward for a serious effort to enhance the tax-filing system is unsure too. As my colleague Saahil Desai defined final 12 months, the company’s pilot of a brand new, free tax-filing program, Direct File, was “a glimpse of a world the place authorities tech advantages thousands and thousands of People.” That this system “exists in any respect is stunning,” Saahil wrote. “That it’s fairly good is borderline miraculous.” Elon Musk posted earlier this month that he had “deleted” 18F, the federal government tech initiative that helped launch Direct File (although Direct File, now underneath the auspices of the IRS, will proceed to simply accept tax returns for now). And Treasury Secretary Scott Bessent mentioned, in his affirmation listening to, that Direct File would function this 12 months, however added that he would “research” it for future use.

Staffing—this 12 months and in future submitting seasons—is one other concern: Janet Holtzblatt, a senior fellow on the City-Brookings Tax Coverage Heart, really useful that taxpayers file as quickly as potential, as a result of the IRS workforce could solely proceed to decrease if among the remaining staff go away for brand spanking new jobs, which might result in tax-refund delays. Lots of those that are left are additionally near retiring. Earlier than 2022, greater than 60 % of the IRS’s staff had been reaching retirement age over the subsequent six years, Holtzblatt instructed me. A brand new cohort of youthful, extra digitally savvy employees (a lot of whom had been probationary brokers) was gearing as much as change them. “The long-term results are probably worse than what would possibly occur this 12 months,” she mentioned.

Extra mass layoffs and funding reductions might imply a shrunken and defanged IRS. If the company doesn’t have the sources it must modernize and tamp down tax evasion, income gained’t be the one factor affected—People’ already-shaky belief within the system could possibly be too.

Associated:

Listed below are three new tales from The Atlantic:

At the moment’s Information

- Elon Musk, who isn’t a member of Donald Trump’s Cupboard, attended the primary official Cupboard assembly of the president’s second time period.

- Trump mentioned that Ukrainian President Volodymyr Zelensky could be in the USA on Friday to signal a rare-earth-minerals deal, which has been a supply of pressure between the 2 international locations.

- An unvaccinated youngster died from a current measles outbreak in Texas, the primary reported measles dying within the U.S. since 2015.

Dispatches

Discover all of our newsletters right here.

Night Learn

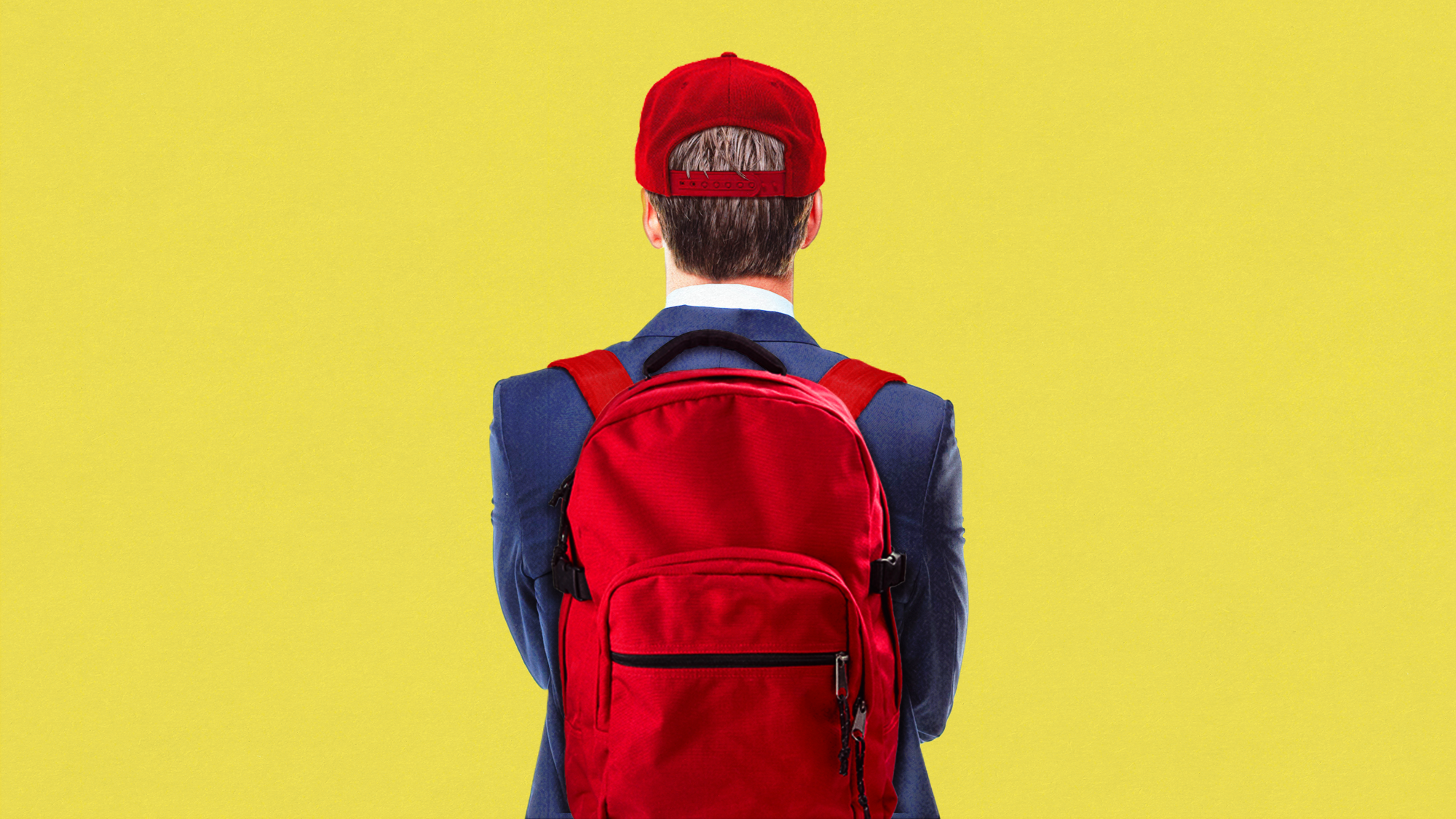

The Adolescent Type in American Politics

By Jill Filipovic

To a sure type of man, Donald Trump epitomizes masculine cool. He’s ostentatiously rich. He’s married to his third mannequin spouse. He will get prime seats at UFC fights, goes on in style podcasts, and does kind of no matter he desires with out penalties. That sure type of man who sees Trump as a masculine perfect? That man is a teenage boy.

Extra From The Atlantic

Tradition Break

Watch. Bridget Jones: Mad In regards to the Boy (streaming on Peacock) finds shocking depth and divulges how the beloved British diarist has outlasted her critics, Sophie Gilbert writes.

Learn. “Chicken Strike,” a brief story by Anelise Chen:

“The lady and her sister had been out jogging by the river once they noticed the chook fall from the sky.”

Stephanie Bai contributed to this text.

While you purchase a e book utilizing a hyperlink on this publication, we obtain a fee. Thanks for supporting The Atlantic.